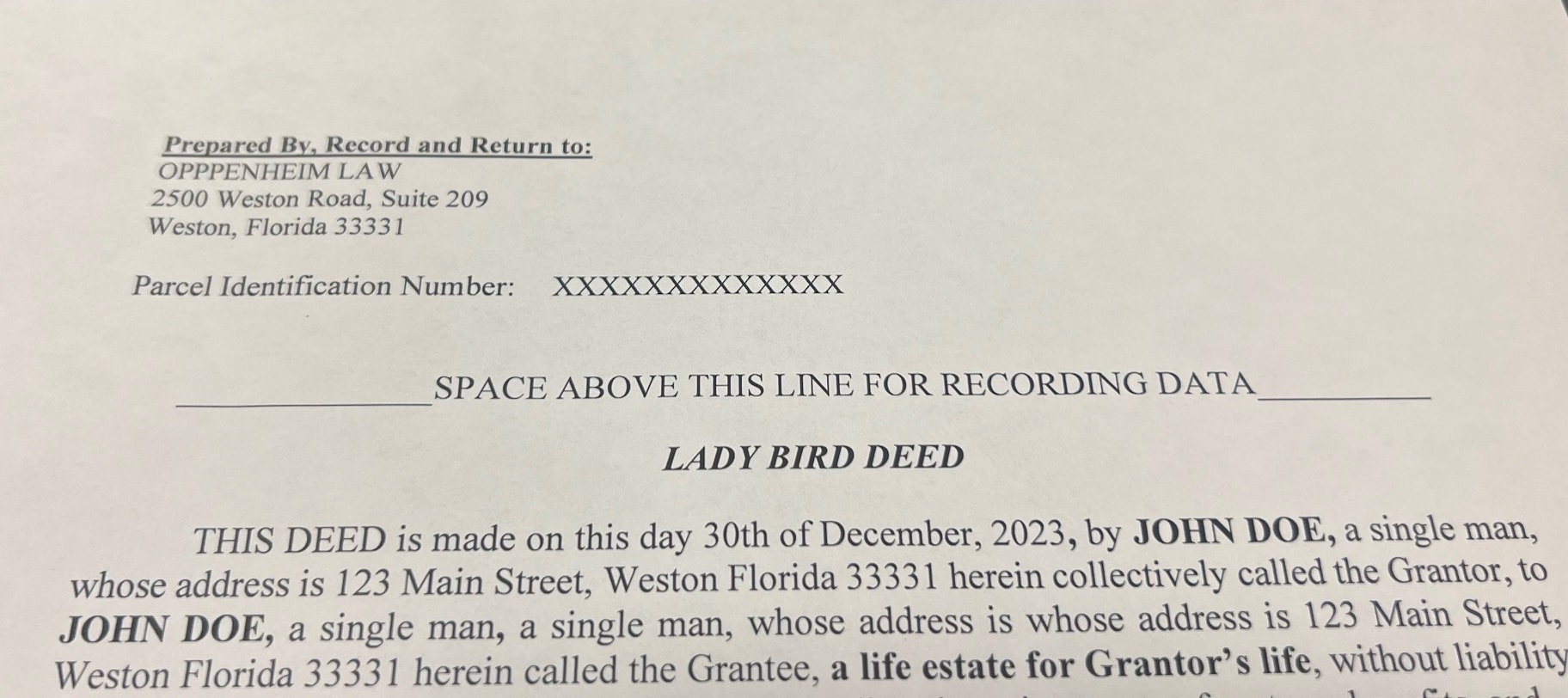

The Lady Bird Deed, also known as an Enhanced Life Estate Deed, is a unique legal tool in Florida’s estate planning arsenal. It allows homeowners to retain complete control and enjoyment of their property while simultaneously ensuring its seamless transfer to designated beneficiaries upon their passing, all without the hassles and delays of probate.

What is a Lady Bird Deed?

In essence, a Lady Bird Deed carves out two ownership interests in your property:

- Life Estate: This grants you the right to live in and use the property as you see fit during your lifetime. You can rent it out, make repairs, and even sell it if you choose.

- Remainder Interest: This designates who will inherit the property outright after your death. This can be one person, several people, or even a trust.

What Makes it Different from a Regular Life Estate Deed?

A traditional life estate deed also grants you the right to reside in the property during your lifetime. However, it comes with a crucial limitation: you cannot sell or mortgage the property without the consent of the remainder beneficiaries. This can be cumbersome and potentially lead to conflict.

The Lady Bird Deed removes this restriction. You retain complete control over the property, with the freedom to sell, mortgage, or gift it as you wish, all while the remainder interest remains secure for your designated beneficiaries.

Benefits of a Lady Bird Deed:

- Avoids Probate: Probate can be a lengthy and expensive process. A Lady Bird Deed bypasses probate, ensuring your property passes directly to your beneficiaries, saving time and money.

- Medicaid Planning: For those receiving Medicaid benefits, a Lady Bird Deed can help protect their home from Medicaid estate recovery programs. By transferring ownership to the beneficiaries before death, the property becomes ineligible for seizure to recoup Medicaid expenses.

- Flexibility and Control: You retain complete control over your property during your lifetime, with the freedom to make decisions as your circumstances change.

- Peace of Mind: Knowing your property will be seamlessly transferred to your loved ones according to your wishes can provide significant peace of mind.

Things to Consider on a Lady Bird Deed:

- Consult with an Attorney: While the Lady Bird Deed offers numerous advantages, it’s crucial to consult with an experienced estate planning attorney to ensure it aligns with your specific goals and circumstances.

- Not a Universal Solution: The Lady Bird Deed may not be suitable for all situations. For example, if you have minor children or a complex family dynamic, other estate planning tools might be more appropriate.

- Potential Tax Implications: Depending on your situation, there may be tax implications associated with using a Lady Bird Deed. Your attorney can advise you on these potential consequences.

Conclusion:

The Lady Bird Deed is a powerful estate planning tool that can offer Florida homeowners significant benefits. However, it’s important to understand its nuances and potential drawbacks before making a decision. By consulting with an attorney and carefully considering your individual circumstances, you can determine if the Lady Bird Deed is the right fit for your estate planning needs. Call 954-384-6114 and speak with an attorney today.