Business Liability Waivers During COVID-19

Sat Jun 20, 2020 by OPLawSocialMedia on Press Releases

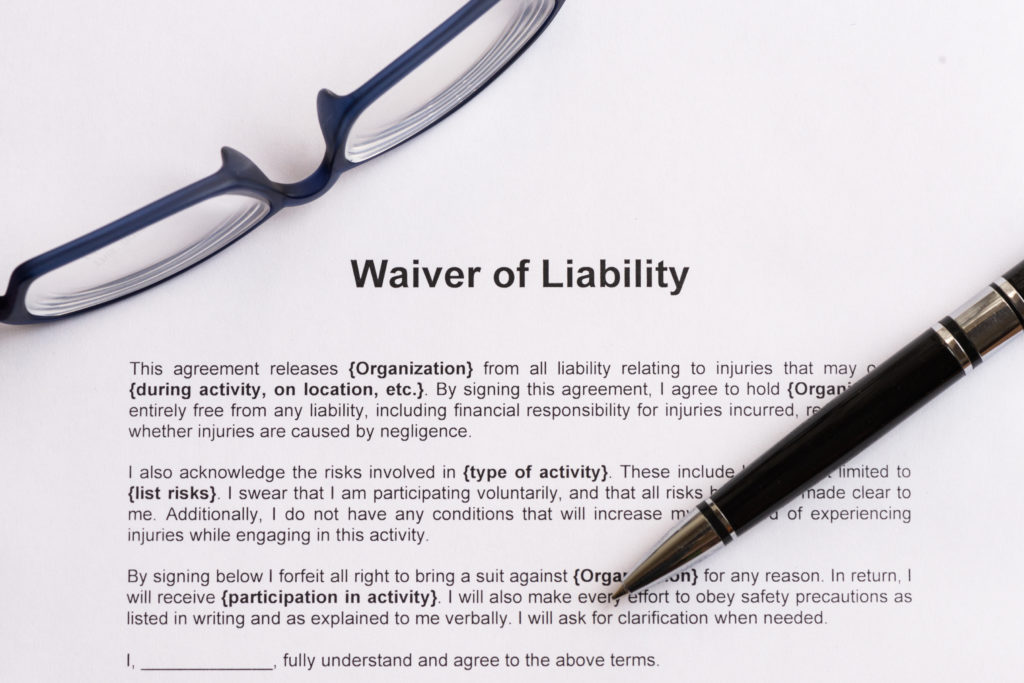

With the reopening of businesses during the general uncertainty as to when the coronavirus will be eradicated, business owners are increasingly becoming concerned about potential liability. As a result, many businesses are requiring both workers and customers to sign waivers saying they won’t sue if the catch COVID-19. The question becomes…are such waivers enforceable?

While there is no federal legislation to act as a liability shield for the business community, there are states –Utah, North Carolina, Louisiana, Oklahoma, Arkansas, and Alabama—that have issued business liability limits through legislation or executive orders protecting business owners if their workers or customers get the coronavirus.

Proponents of Business Immunity

Some businesses, like gyms, amusement parks, and even political rallies, have taken this matter into their own hands by requiring attendees, customers, and workers sign liability waivers pledging not to sue, acknowledging the risk of exposure to the coronavirus. Basically, the waivers are an acknowledgment of your assumption of risk as to possibly contract the virus.

The US Chamber of Commerce and National Association of Manufacturers support liability protection from workplace COVID-19 suits because of the fear that lawsuits would devastate companies already economically challenged by the pandemic. Yet, other groups, such as the American Association for Justice, claim that businesses that take reasonable precautions to safeguard their workers are protected, and that it is difficult to prove that an employee or customer was infected at a specific business. Further, there is an argument that if a business has immunity from such suits, workers and customers may not be as precautious in safeguarding from contracting the virus and may thereby increase the virus’ spread.

Opponents of Business Immunity

Unions such as the United Steelworkers, The American Federation of Teachers, and the United Farm Workers oppose placing a limit on a business’ liability due to the pandemic, fearing that they would lead to laxer safety standards for workers. In essence, unions argue that with immunity, business owners may not be concerned with employees’ safety.

While unions have called for the federal government to issue clearer safety standards for businesses that are reopening, the federal government is concerned with the potential risk of damaging the economy by making it too onerous for businesses to reopen.

Is this a State law issue?

The issue of liability is generally regulated by state law. Florida, along with several others, has revised workers’ compensation rules to allow health care workers, first responders and some other essential workers to be compensated if they become sick with the virus. Generally, however, viruses are usually not covered by Workers Compensation.

Until such time as state laws emerge to tackle the growing concern of liability due to the coronavirus, business owners must refer to CDC, OSHA, Department of Labor, as well as other Federal, State, city, and local guidelines to develop their best practices during this time. Laws will evolve, politics aside, as we confront the substantial impact this pandemic has brought.

From the trenches,

Roy Oppenheim