As The Housing Market Cools, Sellers Cut Prices

Thu Aug 11, 2022 by OPLawSocialMedia on News

Sellers are changing their playbook because of mortgage rates

OVERVIEW

- Why the housing market has been hot in 2022

- What suggests prices are starting to cool down

- How home prices will affect the economy

The housing market is currently full of unhappy people. Among them are sellers who realize they’ve listed their properties too late.

Redfin says home prices are up 44% over the past two years since the pandemic started.

Many homeowners are coming to terms with not getting the same prices their neighbors did lately since prices have cooled. According to Realtor.com, about one in seven homes on the market had a price reduction in June. This is almost double the rate of one in 13 homes a year ago.

Picture courtesy WSJ

More homeowners are considering cutting prices, and they’re facing a lot of difficult decisions all at once. Eventually, the seller may have to accept less than they feel their home is worth or take the home off the market and try again when things get better.

Meanwhile, agents are dusting off their old price reduction playbook.

According to The Wall Street Journal, 33-year-old Jennie Jackson listed her Las Vegas home for $465,000. In March, her neighbor sold a similar home for about $485,000.

It took her 35 days to cut the price three times. She recently accepted an offer for $405,000.

“I thought this may be the highest offer I’ll get so let me get out while the going is good,” said Ms. Jackson.

While there have been price reductions, they’re still far less than what was typical from 2017 to 2019, when one home out of every four or five sold.

There are weakening signs as mortgage rates have risen and inventory has been on the market longer. According to the National Association of Realtors, homes on the market for three months or longer are reducing prices by around 11%.

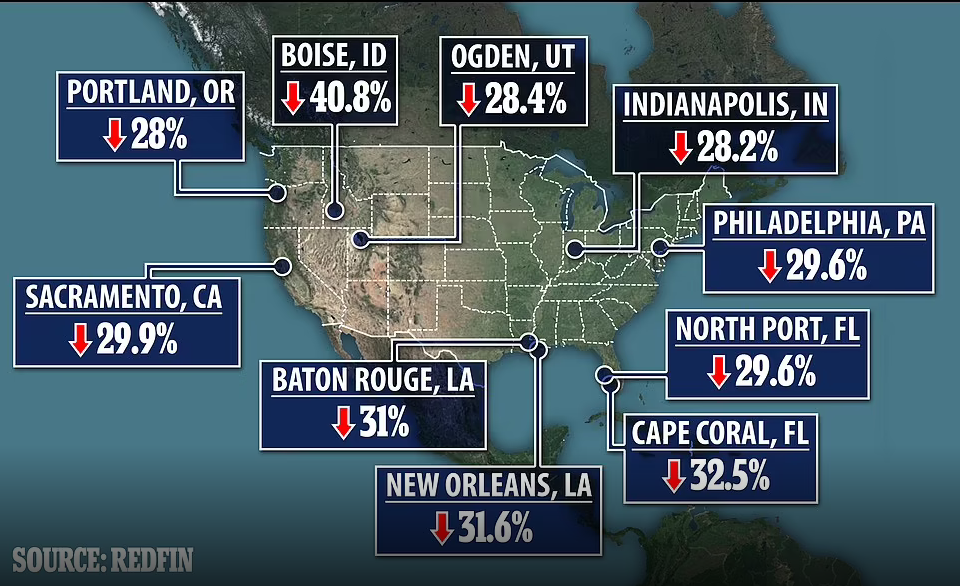

Sellers are slashing prices at levels not seen since before the pandemic as the market rapidly cools. The share of homes for sale has decreased in April, according to Redfin

“The days of bidding wars and homes selling for tens of thousands of dollars over asking are over,” said Daryl Fairweather, chief economist at Redfin.

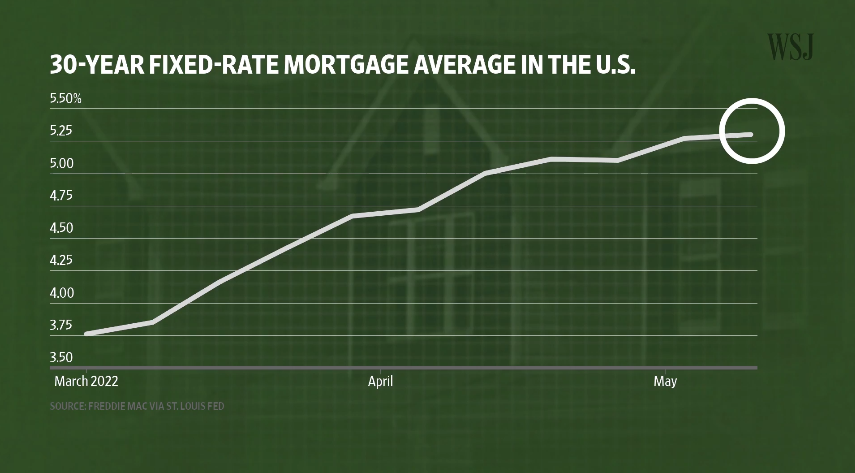

The average rate on a 30-year fixed mortgage dropped back below 5% this week, but the increases this year have priced many buyers out, slowing the pace of sales and causing more inventory to sit, according to Lawrence Yun, NAR’s chief economist.

It wouldn’t have taken long for several sellers he works with to sell their apartments if they listed earlier in the year, said Benjamin Dixon, a real-estate agent in New York City. He said some owners are thinking of cutting their price, while others are thinking of delisting until the fall and still others are thinking of renting their homes out.

For sellers, renting comes with its own challenges.

“Trying to sell a home with a tenant isn’t optimal for showings and becoming a landlord isn’t much fun,” said Mr. Dixon.

By looking at comparable homes in their neighborhood, homeowners usually come up with their list price with their agents’ help. Home prices are usually determined by a home’s age, size, features, improvements, and condition. The higher rates, however, have made those comparisons less useful, said George Ratiu, Realtor.com‘s economist.

It’s hard for many buyers to buy a home with mortgage payments 60% higher than they were a year ago, Mr. Ratiu says. As a result, the sales of previously owned homes for a fifth straight month fell, declining 5.4% to an annualized rate of 5.12 million in June.

For those looking to sell their home, Ms. Fairweather said to talk to your agent about what comparable homes sold for a month ago and price about 5% below that. Instead of pricing too high and having to lower the list price further than you want, sellers should price conservatively out of the gate to get one good offer.

Ms. Fairweather said you only want to drop the price once if you can, so it’s better to make one big drop rather than several smaller ones.

According to Vanessa Famulener, president of HomeLight Homes, the average price reduction should be 8% to 10%. Buyers want to see a noticeable difference, and you want to attract people looking in a different price range.

Incentives that weren’t necessary a few months ago are now becoming more commonplace and are helping some sellers avoid steeper price cuts.

In Austin, Texas, real estate agent Ross Ponder said more sellers are paying buyers’ closing costs and offering flexible move-in dates. Some owners are charging agents more to get more offers.

Amy Schinco, an Omaha real-estate agent, said more sellers are throwing in furniture, sound systems, and even drapes to stand out.

She said, “The market has definitely changed.”.

What Does This Mean?

Right now, the housing market is full of unhappy people, including sellers who regret not listing sooner.

The real estate market is in flux. Oppenheim Law and Weston Title, our sister company, will once again be here to guide you these uncertain times.

From the Trenches,

Roy Oppenheim

For thirty plus years, Oppenheim Law has served local, national, and international clientele particularly in the areas of real estate and business law. Our sister company, Weston Title & Escrow, Inc., has provided title insurance and title related services for three decades. Should you have any questions related to a real estate or business matter, feel free to call us at 954-384-6114 or contact our firm directly at contactus@oppenheimlaw.com, and should you need assistance with a commercial or residential real estate closing, please call us at 954-384-6168 or contactus@westontitle.com.