Florida homeowners who skipped their mortgage payments due to the pandemic are now going to have to resume their payments, as forbearance periods have limits which can range up to eighteen months. While some homeowners may be able to restructure their mortgage loans or move the payments not made to the end of their loans, there still remain homeowners who are in danger of losing their homes because they do not have employment, lack financial resources to maintain their home, or have no longer budgeted a mortgage payment into their finances.

What happened to the federal assistance?

Reports cite to the delay in distributing federal home assistance funds approved by Congress in March as an issue that will cause a ripple effect in the inevitable commencement of foreclosure filings. According to the Mortgage Bankers Association, there are approximately 1.6 million homeowners in forbearance. The number of homeowners at least 90 days delinquent in making their mortgage payment in Florida was 4.01 as of June 30th, while nationwide that number was 3.53.

Florida was allocated $676 million from the $9.96 billion federal assistance fund and has chosen to run a pilot program while seeking approval from the Treasury Department to open its program to mortgage loan borrowers statewide. The reason for the pilot program is because Florida’s Department of Economic Opportunity, the state department which handles Florida’s unemployment compensation program, is currently slated to handle the distribution of the $676 million.

While homeowners wait for the State to obtain the approval to distribute the funds, lenders are recommending that homeowners contact them in order to evaluate their forbearance situation until the necessary assistance comes through. In most instances, federal guidelines prohibit lenders to commence foreclosure proceedings while a borrower is actively attempting to work the lender. However, such protections expire at the end of the year. Should homeowners not seek to reach out to their lender with the hopes of seeking a solution, lenders can begin foreclosure proceedings after 30 days the forbearance ends or if the borrower is unresponsive to the lender’s communications.

Am I eligible?

In order to determine eligibility for the federal funds, the homeowner must own a one- to four-unit residence that is their primary residence; experience a financial hardship after Jan. 21, 2020 (including a hardship that began before then but continued after that date); and, have income less than or equal to 150% of the area median income or 100% of the U.S. median income, whichever is greater. Funding is to be prioritized to ensure assistance is delivered first to the most vulnerable homeowners (targeting incomes of 100% or less of area median income.)

Expenses that can be covered include mortgage payment assistance; financial assistance to reinstate a mortgage or pay other housing-related costs; assistance for homeowner utilities, including internet service and property insurance; delinquent property taxes; and counseling and case management services through a HUD-certified counseling agency.

What Else?

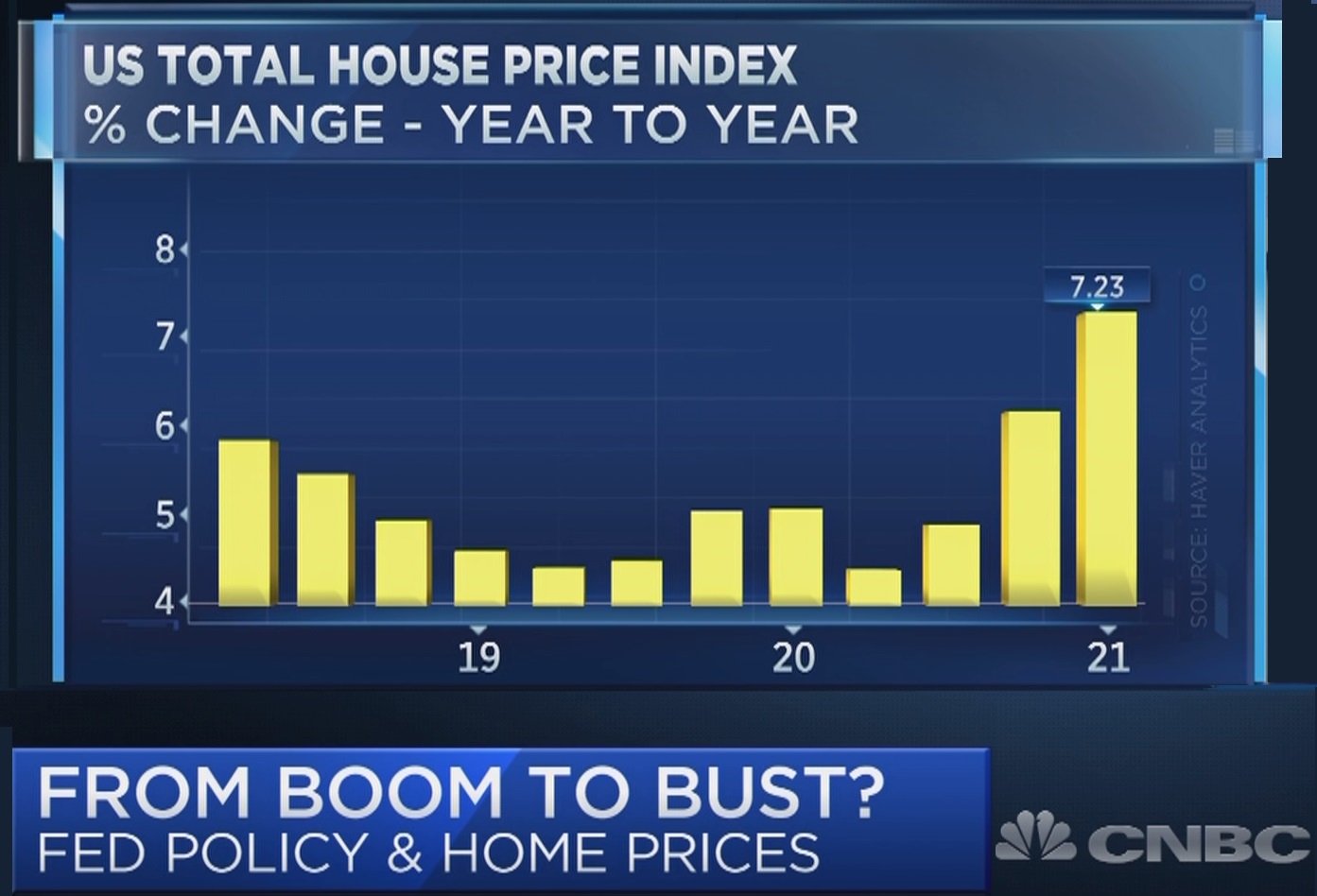

Aside from the likely potential of new foreclosure filings due to the end of mortgage forbearance, there are investors who are sounding the alarm on a housing price bubble, citing to the Federal Reserve’s Covid pandemic policies as its cause and warning that first-time homebuyers are most prone to dramatic losses. Why? Many first-time home buyers who purchased their homes this past year bought them at highly elevated prices because of the materials and labor shortages and the incredible demand over supply.

By way of example, let us assume that a home buyer bought a home that had a sales price of $300,000.00 by borrowing 95% or $285,000.00. If home prices correct by 10% and the home is now worth $270,000.00, the equity that the homeowner had is now gone. As a result, that homeowner may have to sell the house should the homeowner lose employment or need to relocate at a substantially lower sales price (especially if the homeowner bought the home at a highly elevated price). As a result, the homeowner may wind up renting if able to find an affordable rental or, face foreclosure if unable to sell the property.

How can we help?

Our firm has assisted over thousands of homeowners during the foreclosure crisis over the past two decades. We have a myriad of blogs, webinars, and videos regarding foreclosures…what to expect…and…how we may guide you.

Feel free to call us at 954-384-6114 or e-mail us at contactus@oppenheimlaw.com. Should you have any questions or need assistance with the sale or purchase of real estate, our sister company, Weston Title & Escrow, Inc. is able to help you at 954-384-6168 or e-mail us at contactus@westontitle.com.